- Show & Sell

- Posts

- Show & Sell - June 2024

Show & Sell - June 2024

Have you ever dreamt of owning your own little slice of heaven?

Something far away from everyone…

With impeccable views…

A flexible payment structure…

AND at a fraction of the cost of Toronto real estate?

Well then… let me enlighten you.

For only $100 per square meter..

A Spanish pastor is offering plots of land for sale in HEAVEN.

Yep, you read that right - only $100!

And it looks like all major payment platforms are accepted…

… save for crypto.

Jokes aside…

Instead of trying to ‘buy’ your way into a peaceful afterlife… try being a good and decent person today. It doesn’t cost anything to be kind!

June 2024 Highlights:

No New Sales 🛑

Housing (un)Affordability Report 🏘️

Rental Report 🚀

May Inflation Numbers 📈

May Market Stats 📉

NO NEW SALES

Today’s Sales are Tomorrow’s Starts

New Homes Monthly Market Report for May 2024 - Altus Group

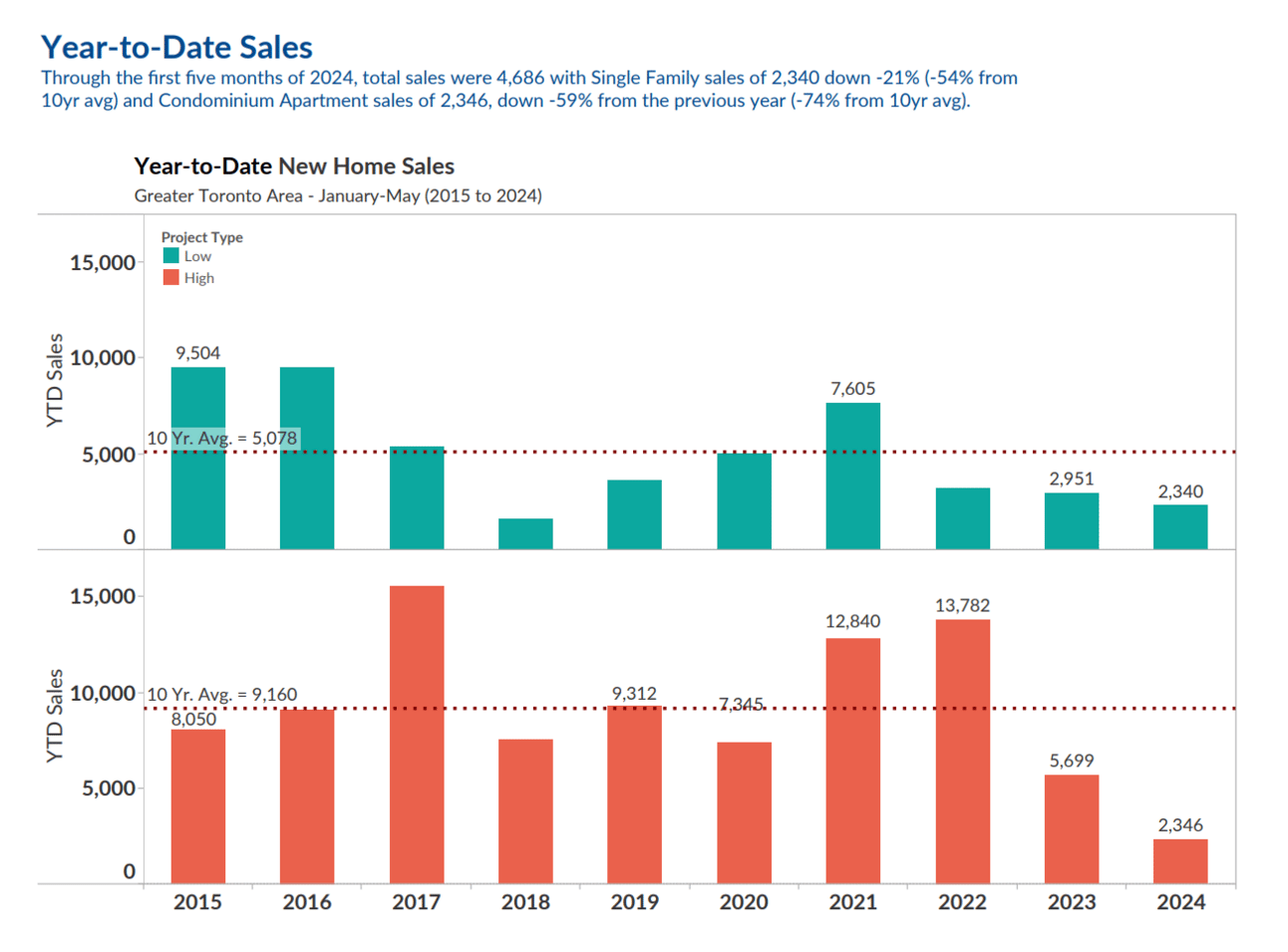

It’s no secret that GTA condos (both resale & new construction) are not selling. But let’s take a closer look at new construction.

New condominium apartment sales are down 74% from the 10-year average.

No one wants to touch new construction condos anymore… at least in the GTA. Skyrocketing prices for micro suites in urban and suburban city centres just aren’t selling like they used to.

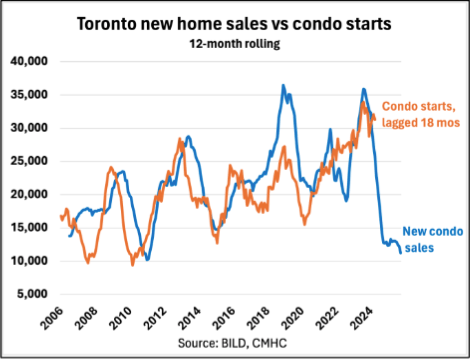

It’s important to note that if new home sales continue to sour, new housing starts will start to fall off:

This means that completions will outpace new housing starts in the months to come. This will have an adverse effect on employment in the construction industry and eventually, an adverse effect on supply if no new construction is taking place!

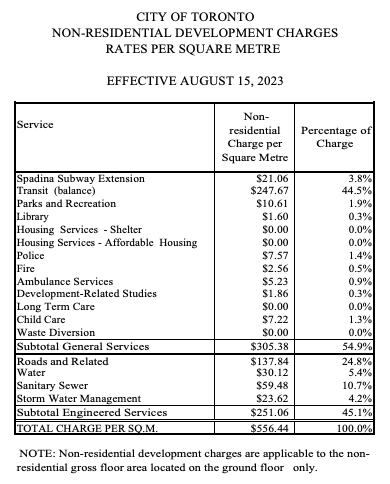

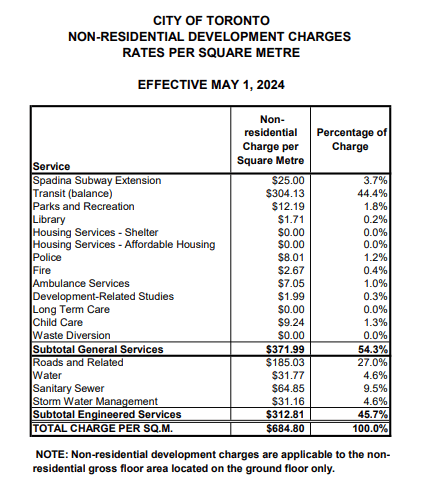

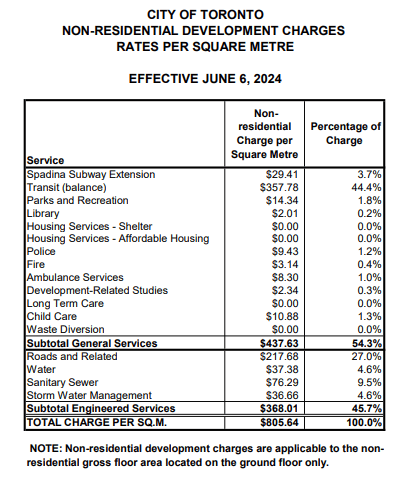

To make matters worse, development charges in Toronto have been skyrocketing.

Development charges are fees collected from developers (and passed on to buyers) to help pay for the cost of infrastructure required to provide municipal services to a new development. Think water and sewer pipes, streetlights, roads, public services, etc.

On May 1st, development charges in the Toronto increased by 20.7%.

On June 6th, they went up again.

Since August 2023, development charges increased by nearly a 45%

On the City of Toronto website, we can find links to past and current DC rates - I’ve posted them below:

August 15, 2023:

May 1, 2024:

June 6, 2024:

Aside from not knowing what your unit is going to look like once built or when it’s going to be built… This is one of the reasons why I’m not a fan of pre-construction.

Having gone through the process for both myself and clients, I have experienced first hand how both developers and municipalities will try to nickel and dime you.

Sure, pre-construction has it’s place in the world. Flexible deposit structures can help you save up for your down payment (or a spot in heaven) but they don’t prepare you for the onslaught of closing costs!

IMPOSSIBLE IS NOTHING

(un)Affordability and Real Estate

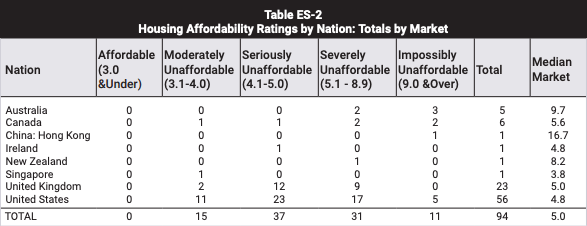

In this year’s latest affordability report, Toronto was ranked as the 2nd least affordable market in Canada. Out of the 94 markets surveyed, Toronto ranked 84th and Vancouver topped 92nd.

The report uses a median multiple to determine housing affordability.

The median multiple is a price-to-income ratio that divides the median house price by the median household income per area.

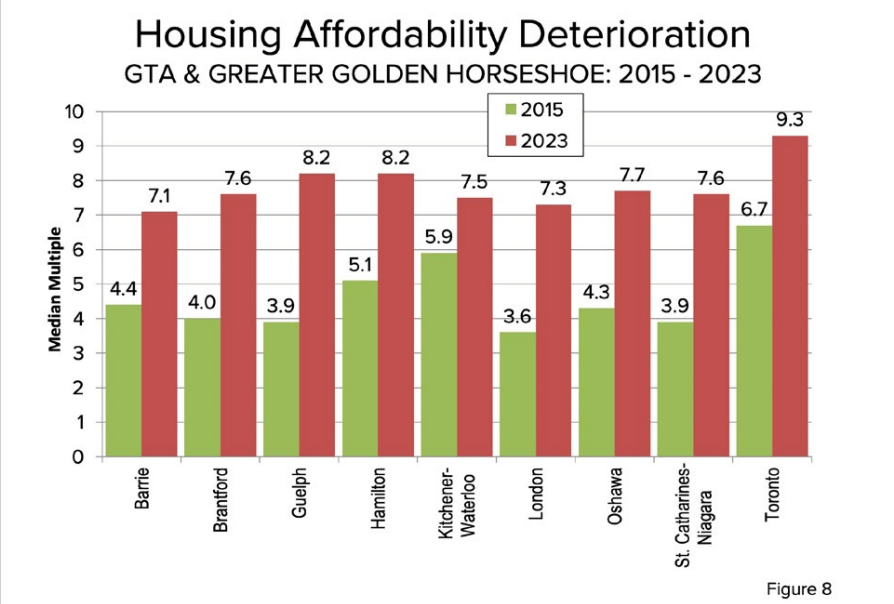

We can see the damage done over the past 8 years, especially in areas once considered affordable like Brantford, Guelph, and London:

DEMOGRAPHIA INTERNATIONAL HOUSING AFFORDABILITY – 2024 EDITION

With a 9.3 median multiple, Toronto is considered impossibly unaffordable. But Hong Kong takes it home with a median multiple of 16.7!

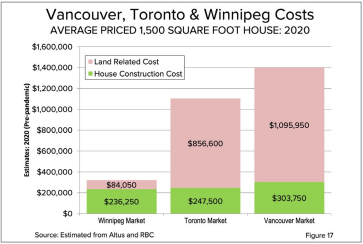

And it’s not like properties in Toronto or Vancouver are built any better than those in say, Winnipeg. A lot of the unaffordability comes from the cost of the land:

Who said to buy land because they’re not making it any more?

Maybe take a pass on Winnipeg…

Or maybe now’s the time to buy?

RENTAL REPORT

Asking Rents in Canada Hit All-Time High

$2,202 was the average asking price for rents across all property types in Canada in May 2024.

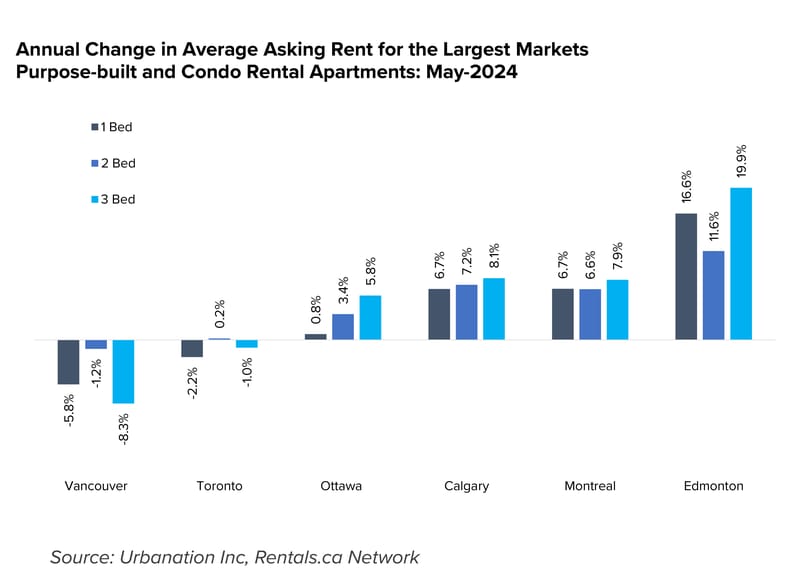

When we look at Canadian cities…

Toronto, Vancouver, and Barrie dropped 4%, 1%, and 11% respectively.

While Halifax, Saskatoon, Regina, Edmonton, Waterloo, and Quebec City all soared 15% or more compared to last year.

From a provincial perspective…

Outside of Ontario and BC, every other province is experiencing a lot of rental demand across all property types.

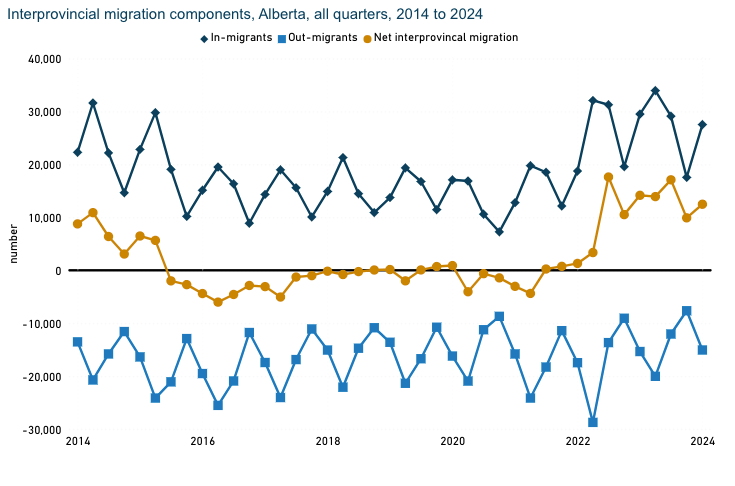

Take a look at the net interprovincial migration for Alberta over the last 10 years:

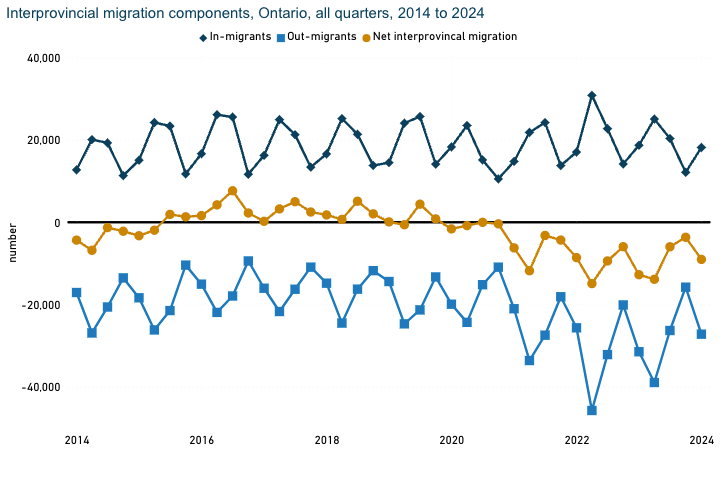

Versus Ontario:

Affordability is the name of the game.

MAY INFLATION NUMBERS

Did We Cut Rates Too Soon?

A lot of Canadians (myself included) breathed a sigh of relief on June 5th when the Bank of Canada announced the first rate cut in near 4 years.

But this week, we’re back to holding our breath.

With inflation accelerating from 2.7% last month to 2.9% for the month of May, markets are now pricing in a less than 50% chance for another rate cut on July 24th.

The main culprits:

Grocery prices accelerating for the first time since June 2023

Increase in prices for cellular services

Higher prices for travel tours & air transportation

Shelter costs up 6.4% year-over-year (mortgage interest & rent)

We are still (barely) within the 1-3% target range but it’s obviously not the numbers we want to see…

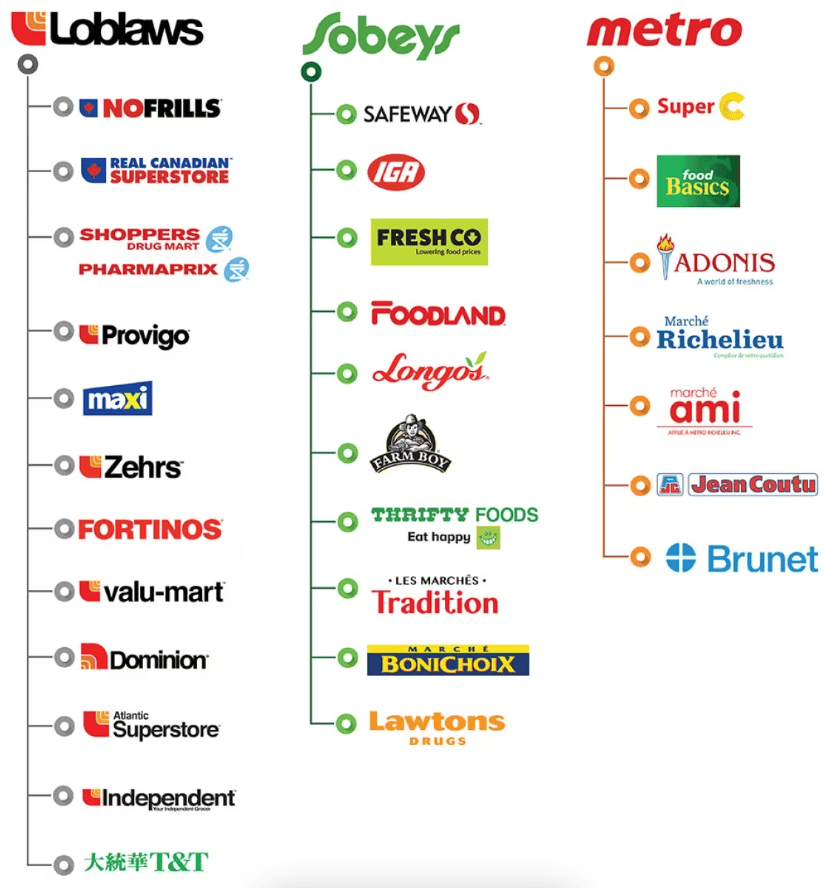

Especially when we don’t have much of a choice between Bell & Rogers or Loblaws, Sobeys & Metro:

Competition Bureau Canada

MAY MARKET STATS

Active Listings Hit 6 10-Year High

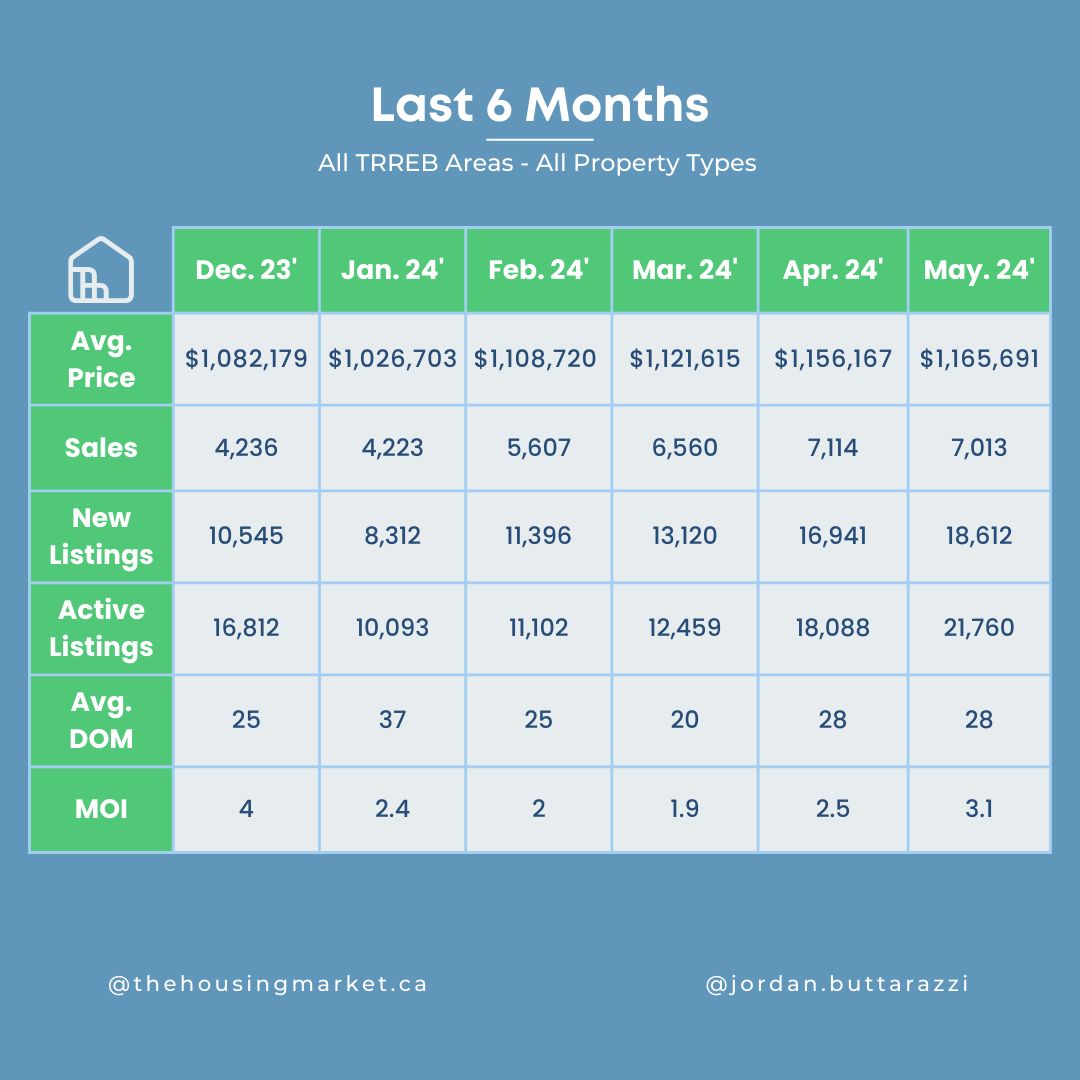

The month of May saw active inventory soar to a decade high, up 82% since last year.

New listings continue to flood the market, up nearly 22% since last year.

With 7,013 transactions in the month of May, sales volume remained relatively flat.

We have entered Buyer Market Territory with a 38% Sales-to-New-Listings Ratio (SNLR).

It’s important to note that new condo listings are up 34% from last year and I anticipate that this trend will continue. Rents are not covering these elevated mortgage costs especially after property taxes and maintenance fees.

Are you interested in a specific market?

Did you know… 🤔

According to Rentals.ca…

“Average asking rents for all residential property types in Canada hit an all-time high of $2,202 in May 2024, surpassing the $2,200 level for the first time.”

Let’s build a plan so you can own a piece of the housing market.

Start by arming yourself with quality information so you can make the most informed real estate decision based on your goals & your timelines.

When you’re ready, let’s chat about…

building your real estate team

the buying process

selling strategies

leasing services

investing in Alberta from Ontario

☎️ Schedule a call today with thehousingmarket.ca

If you’ve made it this far, thanks for reading. Wishing you a stellar summer!

With love,

Jordan Buttarazzi

Follow the socials below!