- Show & Sell

- Posts

- Show & Sell - July 2024

Show & Sell - July 2024

The financial phenom Warren Buffet has a famous quote:

“Be fearful when others are greedy, and greedy when others are fearful”.

Here’s my version:

“Its hard to be fearful when other are greedy, and harder to be greedy when other are fearful.”

Office jokes aside…

During market highs, when others are greedy, we face a few problems making it hard to be fearful AKA cautious:

Herd Mentality - people tend to follow the crowd. When the majority is optimistic and buying, its hard to resist the fear of missing out (FOMO). In the last few years, we saw this everywhere: NFTs, memecoins, stocks, real estate, etc.

Market Euphoria and Overconfidence - during market highs, the media, analysts, your neighbours, your barber, your postman, your realtor, your banker, and your dog will highlight positive news and gains. It becomes difficult to see the potential risks when everyone is focusing on the gains, creating a sense of overconfidence.

Economic Growth and Profits - negative indicators are often overshadowed by strong performance reports during times of economic expansion. It’s hard to be fearful when companies are posting record profits and your neighbour just sold their home for a record-setting price.

During market lows, when others are fearful, we face larger obstacles that make it even harder to be greedy AKA opportunistic:

Negative Sentiment - negative news is dominating the headlines and is overwhelmingly pessimistic. Especially when it comes to Canada, our leadership, our standard of living, and our real estate market. The focus is on losses and not on opportunities.

Uncertainty and Risk Aversion - job losses, declining consumer confidence, and geopolitical instability can lead to heightened senses of uncertainty. The psychological impact of uncertainty and loss, whether experienced or witnessed, fuels our instinct to save money and avoid risk.

Liquidity Constraints - during fearful times, we may face liquidity constraints or challenges accessing funding (more money to debts, harder to get approved for a loan), that can limit our ability to take advantage of lower asset prices even if we can see the potential for future gains.

Both scenarios weigh on the psychological and emotional challenges we all face. Discipline, direction, and a long-term perspective needs to be at the forefront of any decision we make.

July 2024 Highlights:

Cutting SZN ✂️

Closing in Calgary 🏇

June Market Stats 📉

CUTTING SZN

Rate Cuts

Highly anticipated and long awaited with more on the horizon.

The BoC cut rates by 25bps again on July 24th bringing the policy interest rate from 5% to 4.5% in the last 2 months. This is the 2nd rate cut in 2024.

This will impact variable mortgage holders, HELOCs, and personal lines of credit. Fixed rate mortgages are not directly tied to the policy rate. They move with the bond market. However, we’re seeing lenders adjust their rates in response to the overall lower cost of borrowing.

The next rate announcement is on September 4th, 2024. Where we could expect another 25bps cut. Why?

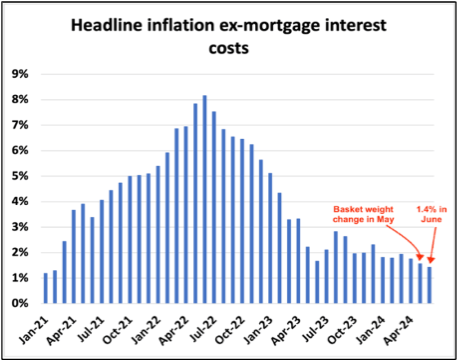

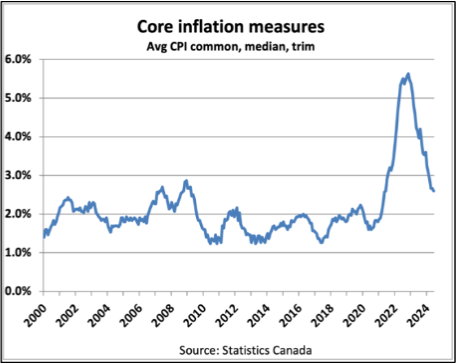

Inflation is cooling. Core inflation measures down to 2.6% year-over-year:

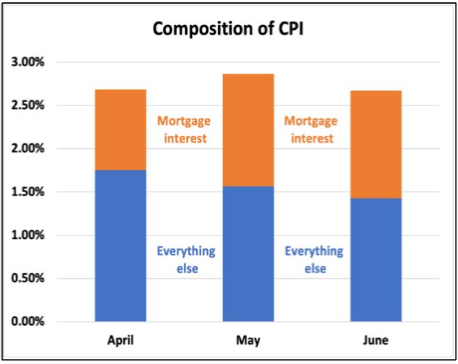

In May, the CPI basket was re-weighted. Mortgage interest costs now accounts for 5.8% of the CPI basket…. adding 1.3% to the headline inflation while everything else is just 1.4%:

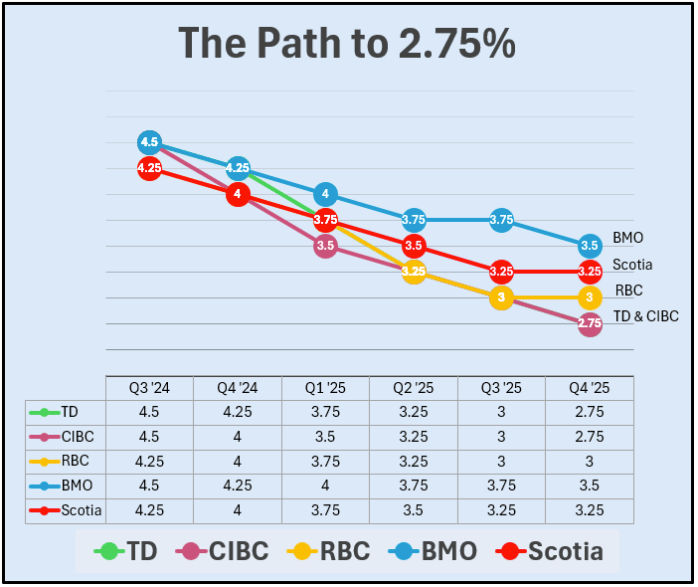

So what’s the next year and a half looking like for rates?

According to TD & CIBC…

2.75%

Aside from rates and real estate, there is a LOT on the agenda for the Canadian and global economy through the end of 2025. And a LOT is going to change.

With major events like national elections - where we’ll see Harris v Trump and Trudeau v Poilievre sparring in the political rings - new and ongoing geopolitical tensions, warp speed advancements in technology (like autonomous robot dentists…) to name a few.

These elements will shape economic policies, market trends, the job market, and the world as we know it. As we navigate these changes, staying informed and flexible will be key. So, buckle up and enjoy the ride!

CLOSING IN CALGARY

T-30 Days and Counting

I’ve never been a fan of pre-construction.

You’re choosing to buy a floor plan for something that doesn’t exist, you don’t know when it’ll get built, you don’t know if it will get built, you don’t understand how much it’s going to cost you, you don’t know what your life or the market will look like once it’s finally time to get a mortgage.

This was all true when I bought a unit on assignment in the Greater Toronto Area…

The project was 3 years behind schedule

Closing costs amounted to $58K (58 THOUSAND DOLLARS) … even after the HST rebate, it was still DOUBLE what you’d pay in closing costs if I bought resale. BTW, there were assignment closing costs + final closing costs…

Spooky phantom mortgage payments (occupancy fees) that do not go towards my mortgage/principal

Closing on the property with rates at record highs

Closing on a condo when the condo market isn’t doing too well

It’s not all bad… the property cashflows, it’s in a great area, and today it’s worth more than what it was purchased for.

The problem I have with pre-construction is that its often marketed as ‘the first rung on the property ladder’ or ‘the best place to start in real estate because you don’t need a mortgage yet’. Those real estate idioms once held some truth. If you bought pre-con pre-covid, you were practically guaranteed to make money.

But in this day and age, where there is a lack of understanding and a lot of expenses, we have to think outside of the box.

Or outside of the province.

And a few years ago, I was presented with another pre-construction opportunity. This time it was in Calgary, Alberta. And I went for it.

The two driving forces?

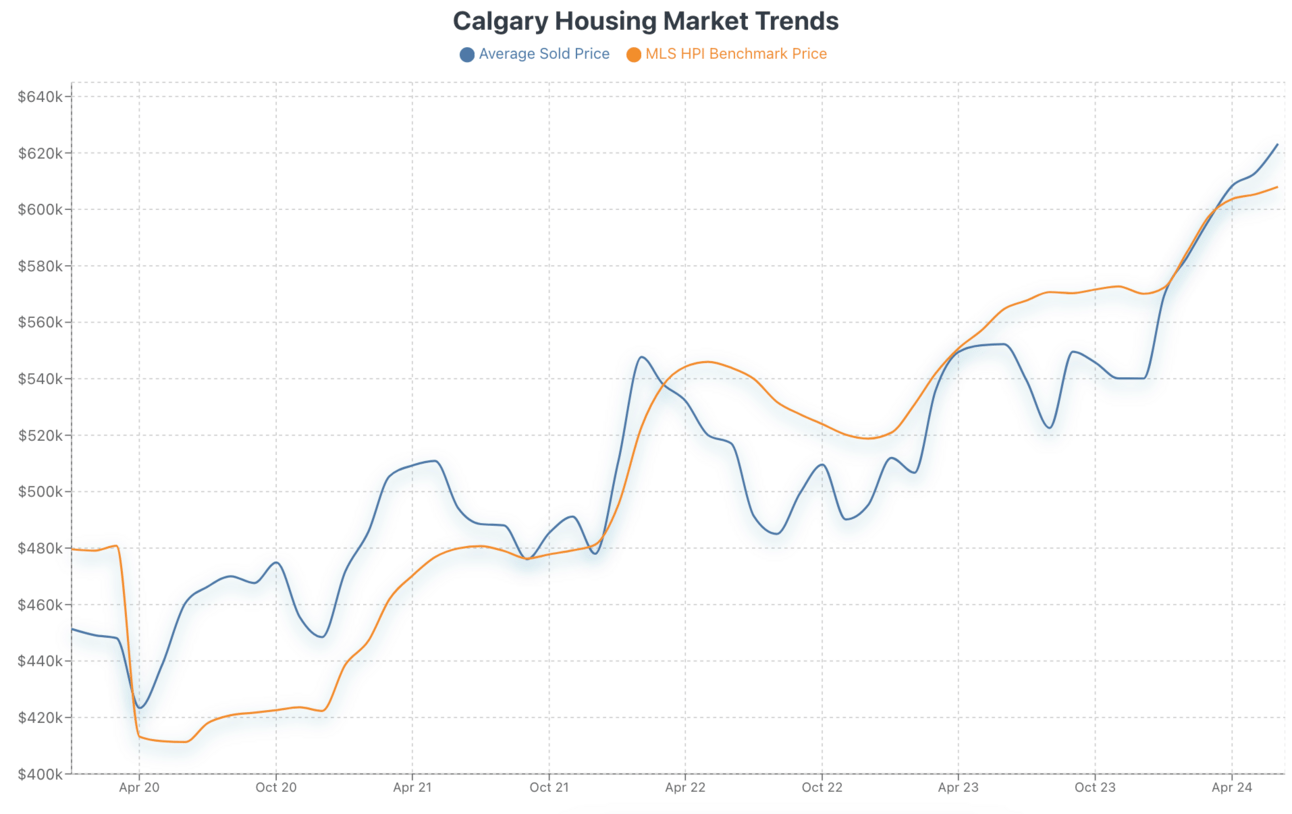

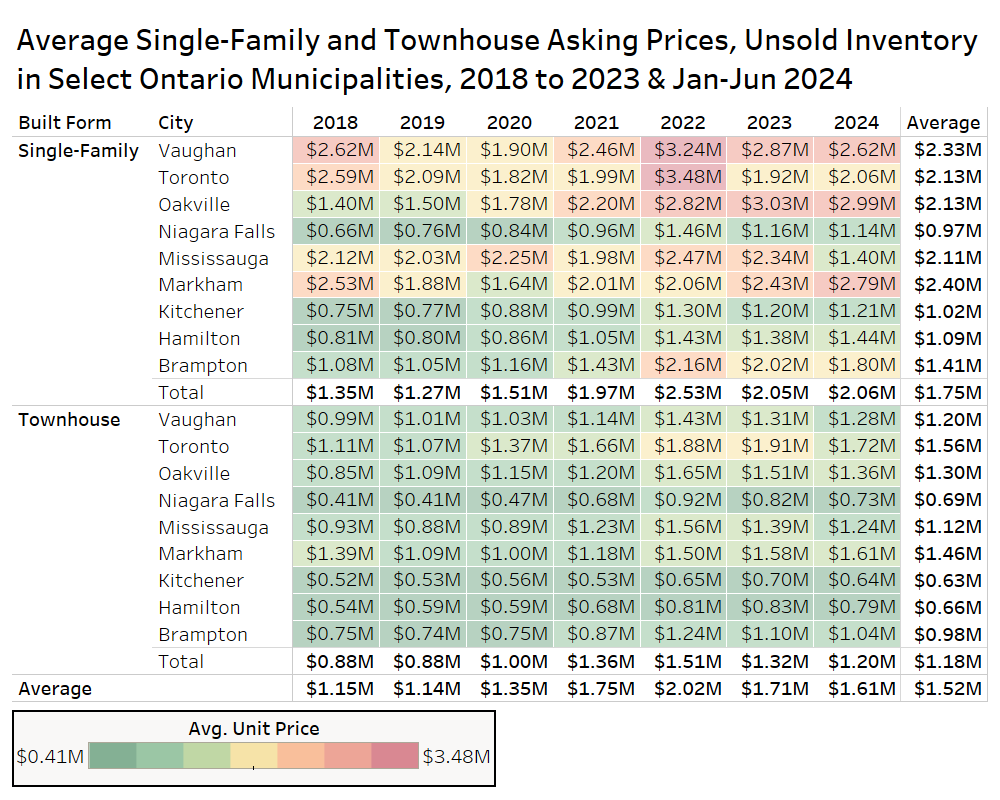

1) Affordability with better potential for appreciation:

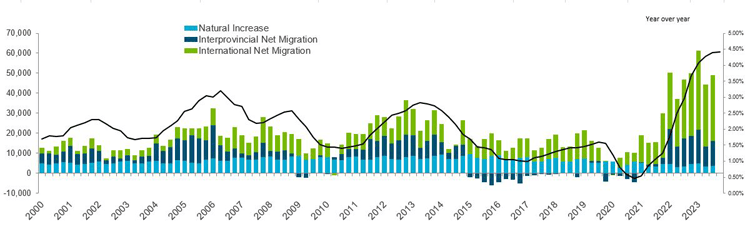

2) Booming interprovincial and international population growth:

Not to mention no provincial sales tax!

And now, we’re only 30 days out from closing. From what was an easy electronic signature a few years ago to now preparing for a mortgage, insurance, tenant placement, property management, legal, closing, budgeting for hiccups…it’s real now!

Am I excited?

Yes! More debt and responsibility!

Do I know exactly what I’m doing?

No, but I’m learning

Is everything in my control?

Helllll no, welcome to real estate!

Do I have any regrets?

Nope… but I’d do things a little differently next time

If you’ve ever thought about buying pre-construction, whether in the GTA or in another province, I can speak from experience on both fronts. And I’d be happy to connect and share what I’ve learnt.

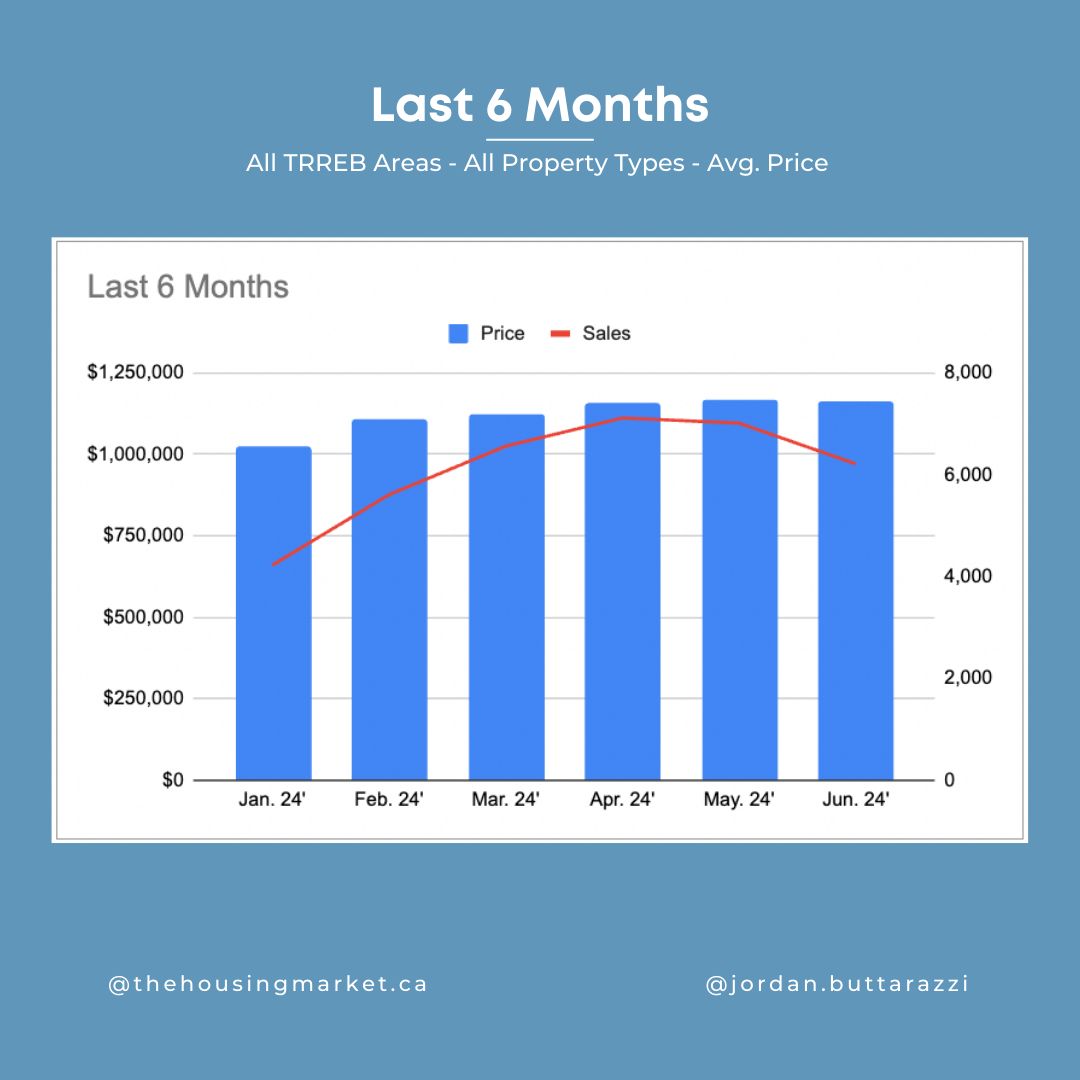

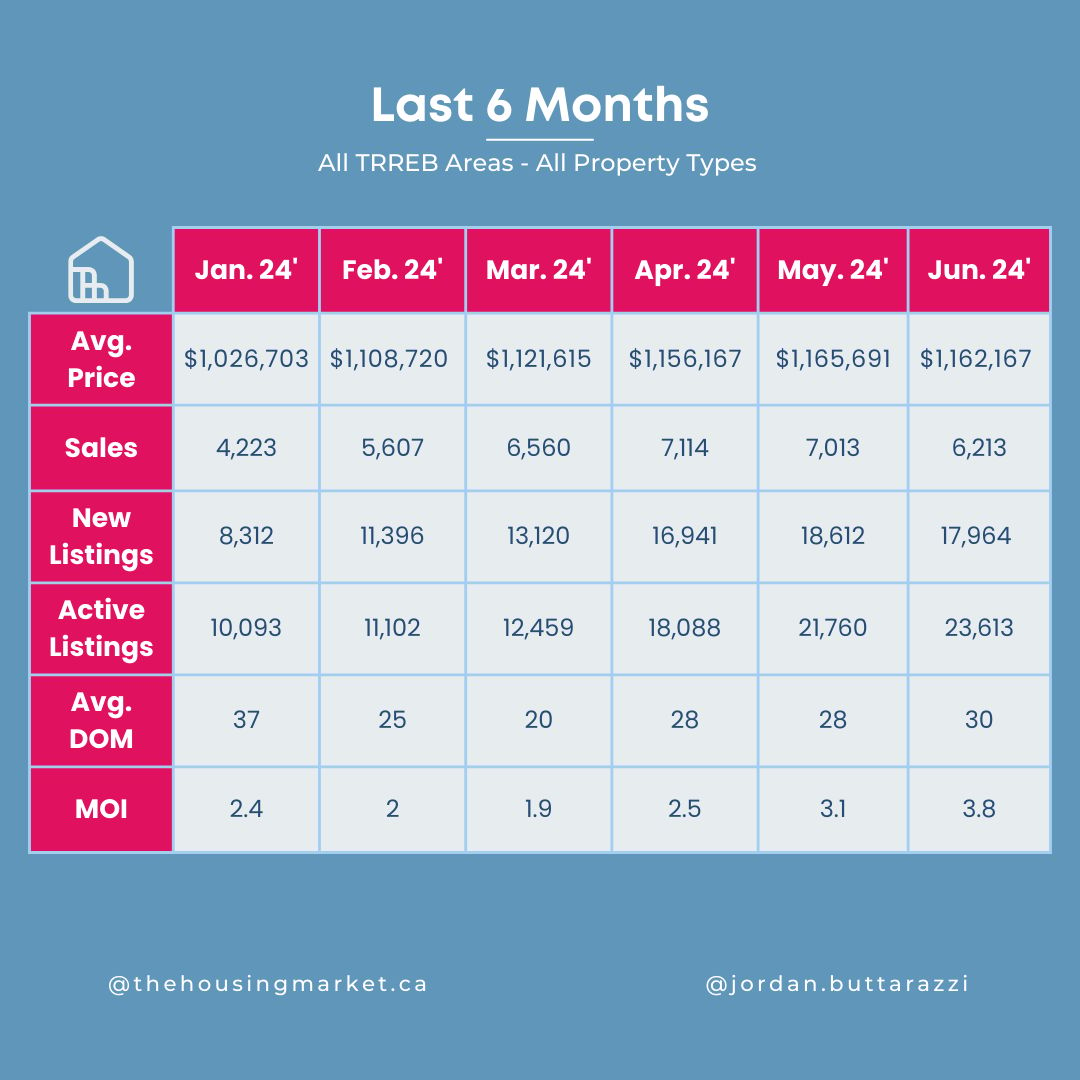

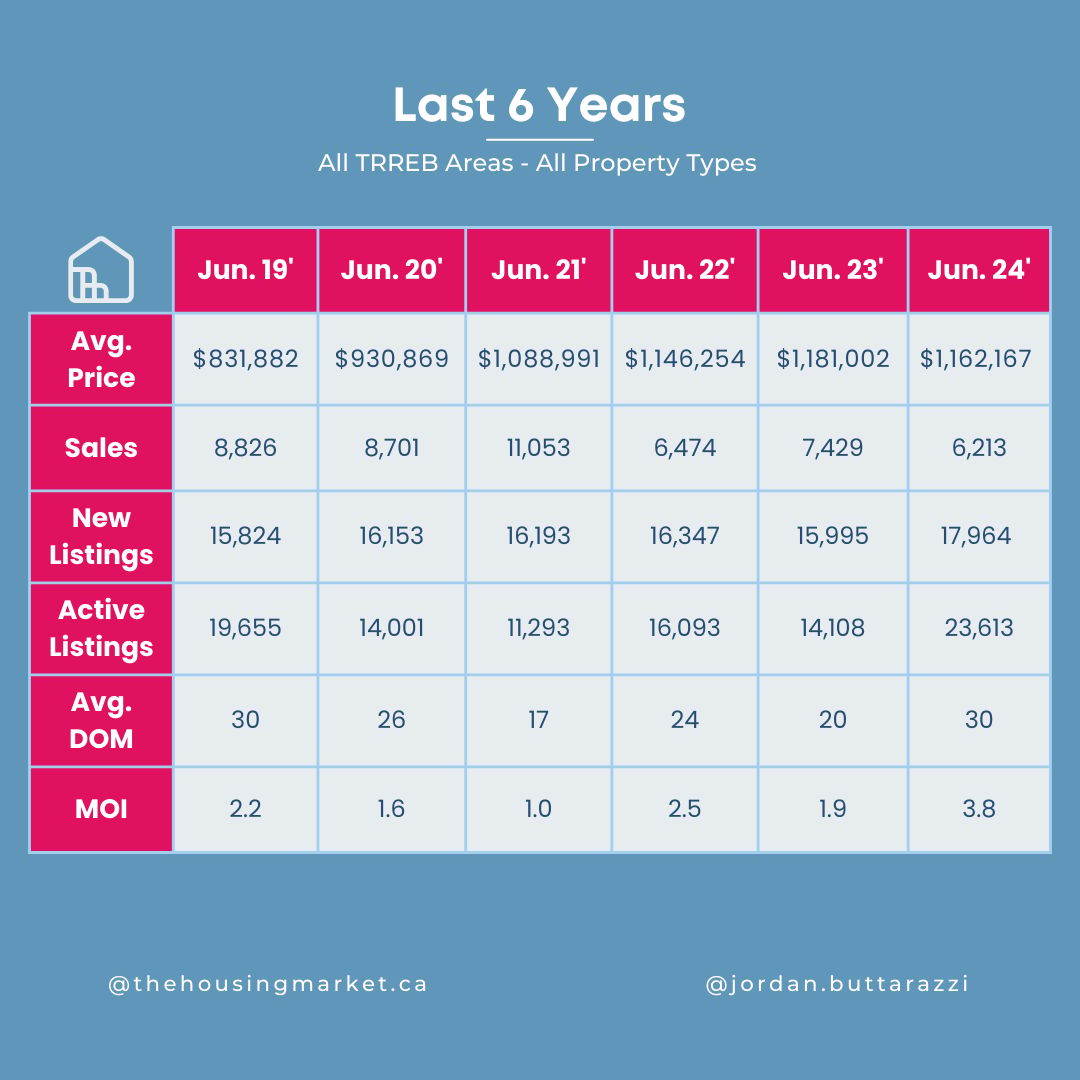

JUNE MARKET STATS

Back to 2021 Pricing

I know, I know. Market stats for June 2024 and it’s July 31st.

Shame on you, Jordan.

I’ve been thinking about changing the format of Show & Sell to include emails twice per month…

1st Email: a more timely market email of a breakdown of sales stats for the previous month

2nd Email: interesting stories about real estate and the economy, from world news to personal anecdotes

Let’s see how that pans out next month…

But first, let’s take a look at last month’s stats.

Pricing for single-family homes have returned to 2021 levels.

The average asking price is down 31% from the July 2022 peak across the GTHA.

Aside from average price holding steady, propped up by single family homes, we’re seeing months of inventory surge across all property types:

Are you interested in a specific market?

Did you know… 🤔

According to Rentals.ca…

“In Toronto, average purpose-built and condominium rents declined 2.5% monthly and 3.5% annually in June, falling to a 22-month low of $2,715. ”

Let’s build a plan so you can own a piece of the housing market.

Start by arming yourself with quality information so you can make the most informed real estate decision based on your goals & your timelines.

When you’re ready, let’s chat about…

building your real estate team

the buying process

selling strategies

leasing services

investing in Alberta from Ontario

☎️ Schedule a call today with thehousingmarket.ca

If you’ve made it this far, thanks for reading.

Can you believe we’re already halfway through summer?

To me, August 1st feels like the halfway point for the year, let alone summer. I don’t know why, it just does. And a halfway point through anything is usually a good time for reflection.

What did I struggle with the most this year?

What am I looking forward to in the next 5 months?

What do I want 2025 to look like? What can I do now to make it possible?

6 months from now, we’ll be crying the blues by how dark it gets by 6:00pm. Get outside and enjoy the weather we’ve been blessed with. Use it to fuel your ideas, goals, and dreams.

With love,

Jordan Buttarazzi

Follow the socials below!