- Show & Sell

- Posts

- Show & Sell - April 2024

Show & Sell - April 2024

From dovish tones of a potential rate cut in June to new efforts by the Federal government to prop up the housing market, 2024 is shaping up to be a wild one. There has been a lot going on in the month of April.. and we’re only halfway through!

Welcome to Show & Sell…

April 2024 Highlights:

Federal Budget 2024

March Inflation Numbers

BoC Holds Rates

Blackstone’s Big Bet

GTA Stats - March 2024

👇 Watch: Enhanced HBP, 30-Year Amortization for First Time Buyers, Toronto’s ‘Rain Tax’, FB Marketplace Nightmares, and my love for Shell Gas.

FEDERAL BUDGET 2024

Debt & Taxes

It’s like death and taxes… the two universal guarantees in life, as the old adage goes. However, debt seems like a more appropriate theme (& guarantee) from yesterday’s Budget 2024 announcement.

With spending topping $53 billion more than planned over the next five years, a $40 billion deficit this year, an increase to the capital gains tax, and the government spending more on servicing its debt than on health care…

As a Canadian… debt & taxes makes a lot more sense, eh?

Aptly titled Fairness for every generation, below I will highlight a few biggies from Chapter 1: More Affordable Homes.

1.1 Building More Homes

Unlock 250,000 new homes on federally owned land: long-term leases to builders, building homes on Canada Post properties & National Defence lands, & converting underused federal offices into homes

Taxing vacant land to incentivize construction: the government will consider introducing a new tax on residentially zoned vacant land

Low cost construction financing programs for rental apartments: adding $15 billion in new loan funding (totalling $55 billion) to help build 30,000 new homes across Canada - program hopes to achieve 131,000 new homes by 2031

Canada Housing Infrastructure Fund: $6 billion over 10 years in an effort to accelerate infrastructure construction. Provinces and territories can only access funding if they commit to actions that increase housing supply

Innovative Residential Construction: building more homes faster through modular homes, 3D printing, mass timber construction, addressing regulatory barriers, a housing design catalogue and low-interest loans (up to $40,000) for homeowners to add secondary suites to their homes

Incentivize builders and schools: increasing Capital Cost Allowance rate for apartments from 4% → 10%; removing GST on new student residences

Skilled trades workers: the construction sector faces a shortage of 60,000 workers by 2032. $100 million proposed to create placements; $50 million proposed to streamline foreign credential recognition

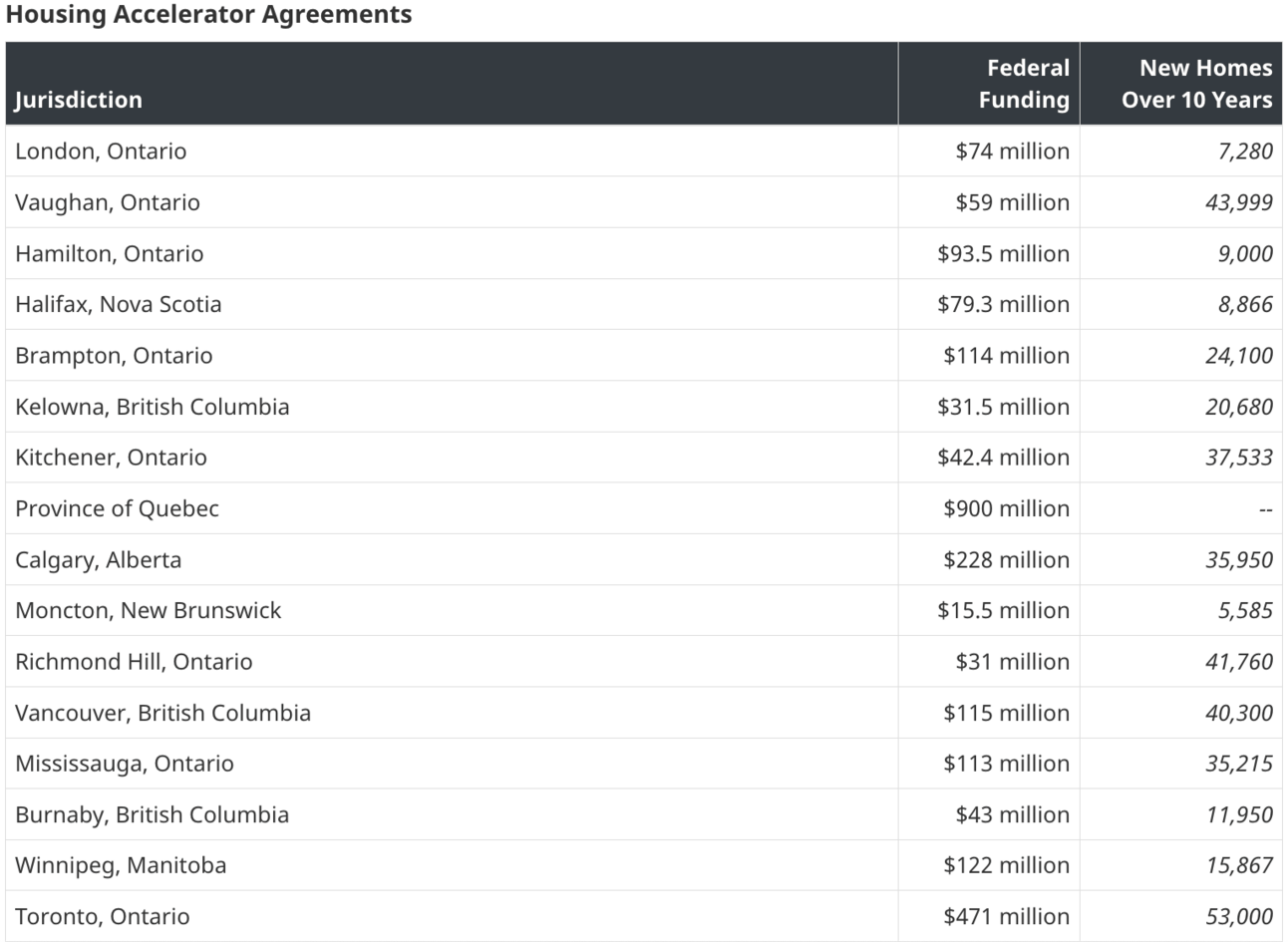

Topping-up the Housing Accelerator Fund: $400 million to be added in an effort to fast-track 12,000 new homes in 3 years

Okay there’s a lot on the topic of housing (as there should be)… so we’ll rapid fire a few more:

30-year Amortization on new builds for first time home buyers with <20% down: aimed to spur demand in new construction (especially GTA condos) = more debt for longer

Enhanced Home Buyer’s Plan: $35K → $60K RRSP withdrawal + 3 year grace period to start repayment. Can be used in tandem with FHSA. Curious to learn how many first time buyers have $35K+ in their RRSPs..

Credit for Paying Rent: intended to help renters improve credit score for when they apply for a mortgage

Foreign Buyer Ban extended to January 1, 2027

Intentions to restrict the purchase of single-family homes by large corporate investors: more on this below!

A lot of good ideas, viable solutions, and promises to fix our country’s housing crisis.

But we how do we fix our government’s debt crisis?

By taxing the rich!

NEW CAPITAL GAINS INCLUSIONS

So much for 50-50

In an effort to increase federal revenues by about $20 billion over five years, changes to the capital gains inclusion rate are in the works.

As of June 25th, 2024… the government intends to increase the inclusion rate on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corps and trusts, from one-half to two-thirds.

Let’s break it down:

You’re an individual that owns 2 properties:

Your primary residence and your investment property.

You bought the investment property 10 years ago for $500K.

Today, it’s valued at $1 million and you want to sell.

You sell it for $1 million.

After all is said and done, you realize $450K in profit - also known as capital gains.

Capital gains are the profit from the sale of an asset, such as stocks or real estate.

Unfortunately, you need to pay tax on those capital gains. 👎

Today, only one-half of your capital gains are taxable.

$450K taxed at 50%

Total taxable capital gain = $225K

As of June 25th, 2024… any capital gain realized over $250,000 will be subject to the new two-thirds inclusion rate.

So, of the $450K profit made:

$250,000 taxed at 50% = $125K

$200,000 taxed at 67% = $133K

Total taxable capital gain = $258K

The amount of tax you actually pay will depend on your province and blended tax rate.

It’s important to note that any amount you make when you sell your home (principal residence) will be exempt from capital gains taxes.

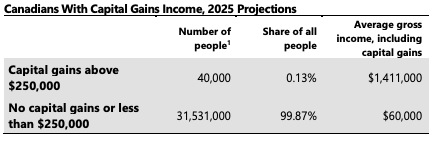

Most Canadians don’t have to worry too much… only about 40,000 people have capital gains above $250,000:

Try not to cringe at the income difference between the top 0.13% and the rest of us…

MARCH INFLATION NUMBERS

Inflation up… slightly

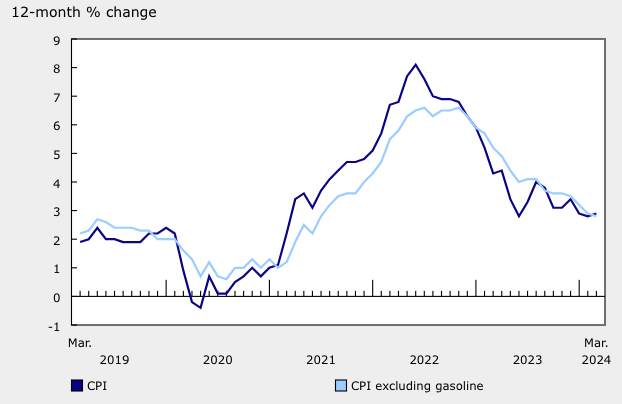

Canada’s annual inflation rate ticked up last month, rising 2.9% in March. Who are the (same old) culprits?

Gas & shelter.

On a year-over-year basis… Gasoline prices increased 4.5% in March. Supply concerns, geopolitical conflict and voluntary production cuts are leading to higher prices at the pump.

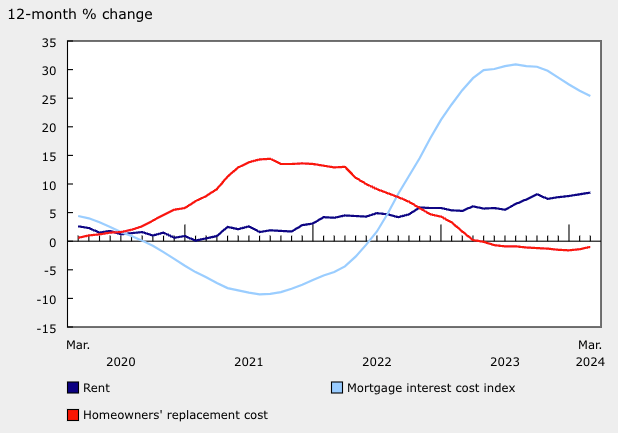

12-month change in the CPI & CPI Excluding Gasoline

On a year-over-basis… Rent prices rose to 8.5%, following an 8.2% increase in February. The mortgage interest cost index rose 25.4%, down from the 26.3% increase we saw in February.

Mortgage interest cost index remains elevated

Excluding gasoline… CPI slowed to a 2.8% year-over-year increase. Down from 2.9% in February.

However… we welcomed the carbon tax increase this month. This will have an impact on next month’s CPI numbers.

BoC RATE STATEMENT

June Rate Cut in ‘Realm of Possibilities’

“the decline we’ve seen in momentum is very recent…wage growth has only just started easing…inflation expectations for households are only coming down very slowly.”

The Bank of Canada held rates on April 10th, 2024. Tiff Macklem also noted that a June rate cut was in ‘the realm of possibilities’.

Since then, we received the latest inflation figures for March as well as Budget 2024. Both of these don’t give me confidence in a June 5th rate cut.

Although inflation has stayed under 3% since the beginning of the year, I am anticipating cuts towards end of 2024.

BLACKSTONE’S BIG BET

Blackstone’s $10 Billion Deal to Purchase AIR

Blackstone is on a buying spree in 2024.

Earlier this year, they bought Tricon Residential, which owns 38,000 homes across the U.S. and Canada. That came with a purchase price of $3.5 billion.

Earlier this month, it was announced that AIR Communities would be the next acquisition. AIR has a portfolio of 76 apartment communities marketed to high-end renters. What’s a high-end renter? Well, in 2023, the average household income of the company’s tenants was $237,000. With average rents of $2,700 per unit.

USD.

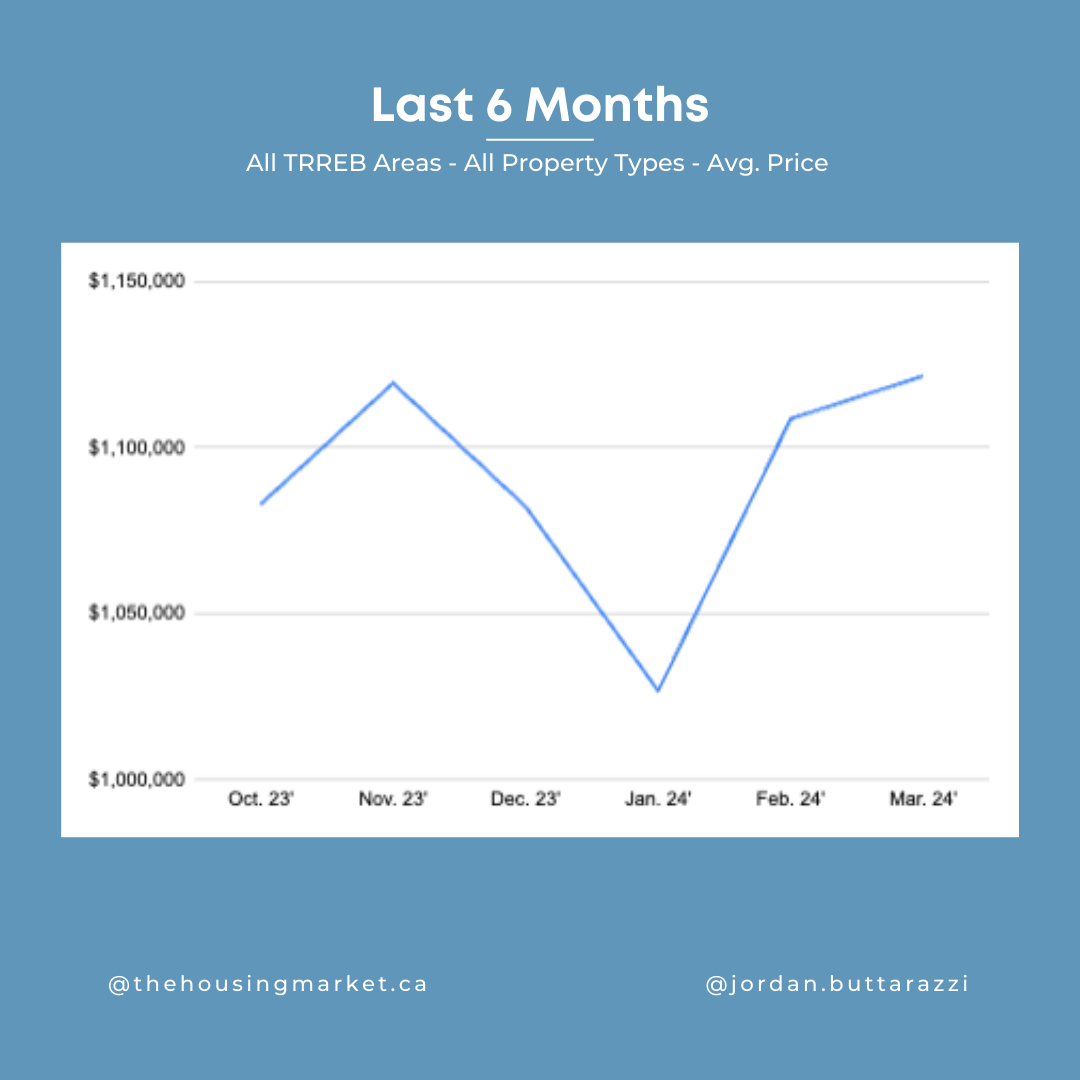

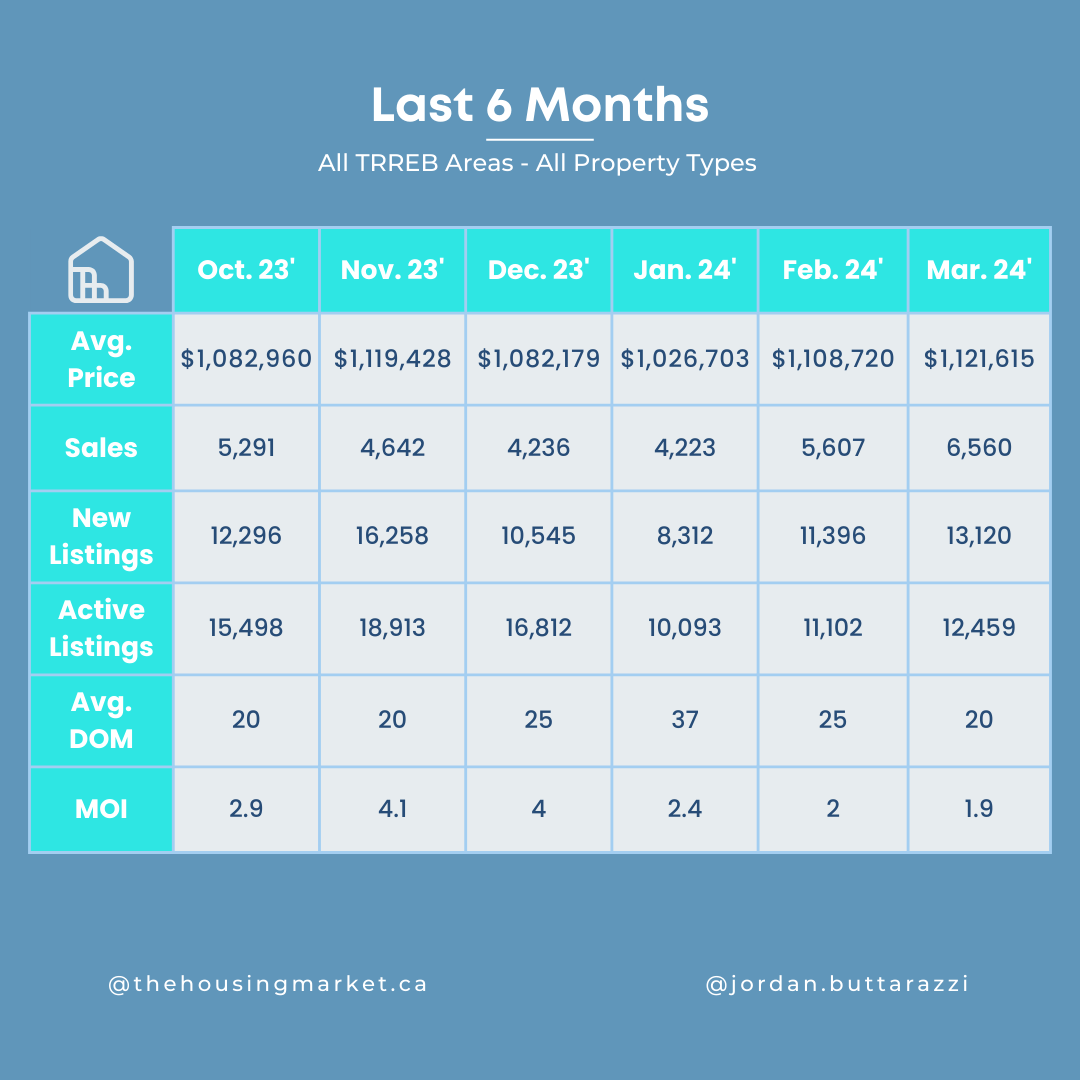

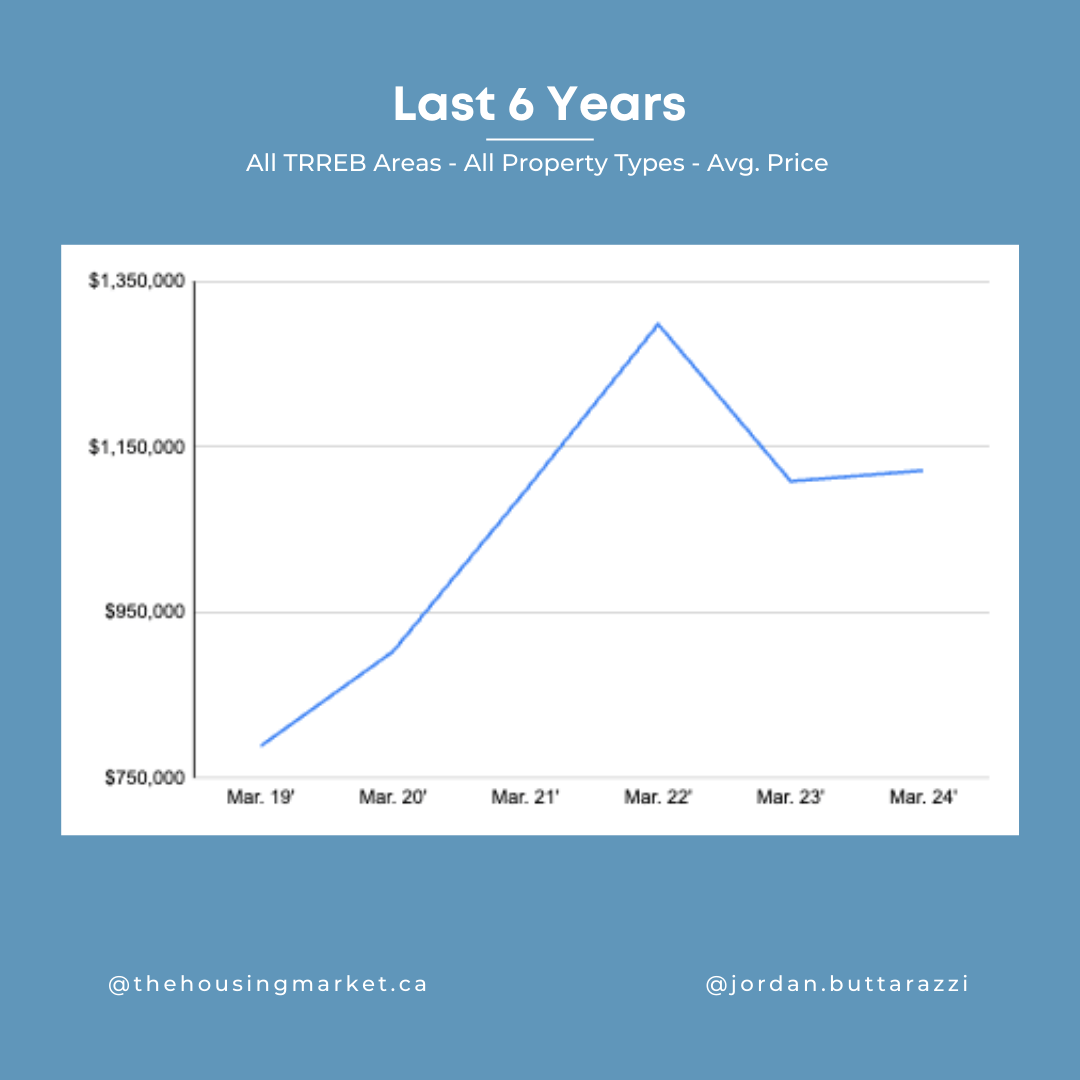

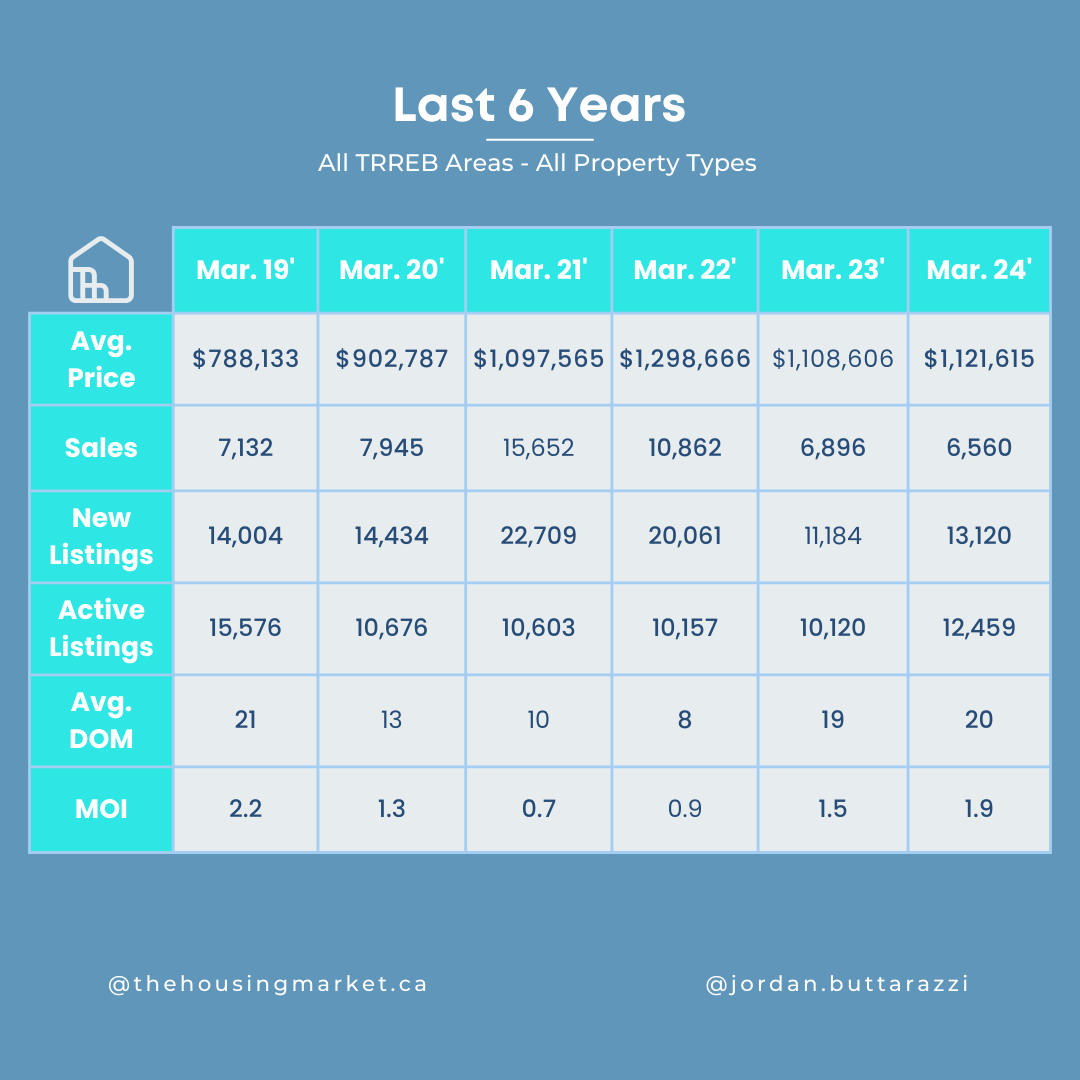

GTA STATS - MARCH 2024

Lowest March sales since 2009

The spring market is off to an interesting start. Sure, there were more holidays than usual last month. However, there were only 6,560 recorded sales… we haven’t seen sales volume this low since for the month of March since 2009… 6,170 sales with an average price of $434,696.

Compared to March 2023…

Sales down 4.5%

New listings up 15%

Avg. selling price up 1.3%

*Important to note that majority of new listings are in the condo market

Are you interested in a specific market?

Did you know… 🤔

Compared to March 2020, average asking rents in Canada increased by 21%. That’s equal to an average annual increase of just over 5% over the last 4-years.

Let’s build a plan so you can own a piece of the housing market.

Start by arming yourself with quality information so you can make the most informed real estate decision based on your goals & your timelines.

When you’re ready, let’s chat about…

building your real estate team

the buying process

selling strategies

leasing services

investing in Alberta from Ontario

☎️ Schedule a call today with thehousingmarket.ca

If you’ve made it this far, thank you.

It’s been two years since I started this newsletter. I’m regularly testing and iterating different layouts and ideas for content.

If you enjoyed this newsletter, please…

If you weren’t a fan… let me know where I can improve!

That’s the only way we get better.

With Love,

Jordan Buttarazzi

Follow the socials below!